The International Finance Corporation (IFC), the private investment arm of the World Bank Group, is pouring US$250 million into the Bank of the Philippine Island’s (BPI) green bond, which aims to finance renewable energy and electric vehicle projects in the Philippines.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

In the biggest deal the IFC has done with a financial institution in the Philippines yet, the bond will support the country’s aim to increase the share of renewables from the current 21 per cent to 35 per cent by 2030 and 50 per cent by 2040.

BPI’s green bond, its third issuance since 2018, is slated to raise money for projects such as renewable energy, energy efficiency, green buildings, electric vehicles and climate-smart agriculture projects, the global development institution said in a statement on Thursday (10 August).

IFC is the sole subscriber of the bond, which will be aligned with the International Capital Market Association’s Green Bond Principles.

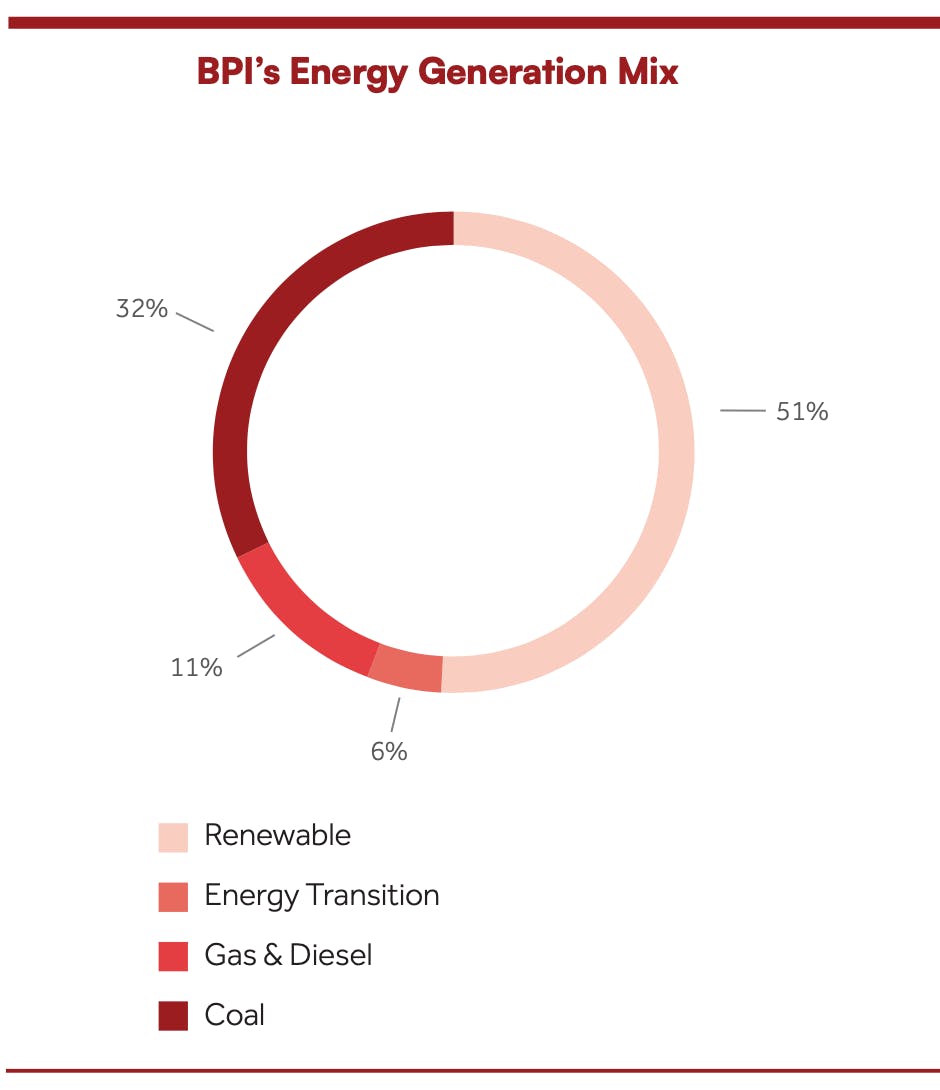

BPI’s total power generation mix includes 51 per cent worth of renewables financing , although 43 per cent still funds fossil fuels. Source: BPI Integrated Report 2022

BPI’s total power generation mix includes 51 per cent worth of renewables financing , although 43 per cent still funds fossil fuels. Source: BPI Integrated Report 2022As much as three quarters of the population of the Philippines is vulnerable to the impacts of natural hazards, which are projected to result in economic damages worth of up to 7.6 per cent of gross domestic product by 2030, based on latest data from the World Bank.

BPI, the country’s third largest bank in terms of assets, has renewables accounting for 51 per cent of its power generation loan portfolio as of 2022, with 32 per cent devoted to coal. The remainder is mostly for gas-fired projects.

Although it announced two years ago that it will cease coal financing by 2033, it continued to invest in coal projects between April 2022 and March 2023.

BPI president Teodoro Limcaoco previously said that the country cannot do without fossil fuels just yet, citing how “our clean energy transition might be slow but we will get there” and how a transition to renewables “cannot be overnight.”

Join the conversation on how the Philippines can unlock sustainable finance. Register here for Unlocking capital for sustainability Philippines on 14 September 2023.