Less than a year after Malaysia’s first voluntary carbon exchange was launched, the country’s leaders have called out firms for not making good on their talk about the environment and sustainability.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Bursa Carbon Exchange (BCX), the country’s first voluntary carbon marketplace, has seen lacklustre participation since its first auction in March this year and the start of trading last week, its chief said.

“I must admit I was rather disappointed, and would have liked to see more companies participate in the auction and initial trading,” said Muhamad Umar Swift, chief executive officer of the Malaysian stock exchange regulator Bursa Malaysia, which also owns and operates BCX.

Trading and off-market transactions on BCX began on 25 September, and 10 companies participated in the “go-live trading”, said Bursa in a statement last week. Only two of those companies were among the 14 firms which had first bought carbon credits in BCX’s initial auction held six months ago.

While 16,5000 units of carbon credits were traded by the 10 companies in the first two days, subsequent trading days have seen a total of just 80 units traded over the past week, according to BCX data. There were also days during which no carbon credits were traded.

“Corporate Malaysia, do step up and show your interest to purchase or to produce carbon credits,” said Umar on Thursday at the inaugural Malaysia Carbon Markets Forum.

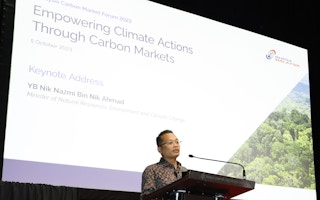

At the same event, Malaysia’s minister of natural resources, environment and climate change Nik Nazmi Nik Ahmad echoed this sentiment, telling companies that they should “put their money where their mouths are” by supporting national efforts on sustainability.

“(Given) the size of our market, without strong support from Corporate Malaysia, we will not be able to grow (our carbon market) to scale,” he said. Despite Malaysian companies having talked about climate change, the environment and sustainability, many also dropped out from the government’s green electricity programme when the government hiked tariffs earlier this year, Nik Nazmi added.

Carbon markets were spooked earlier this year when investigative reports alleged that more than 90 per cent of carbon credits certified by the world’s largest certifier Verra overestimated the climate impact of projects.

Malaysia’s environment minister warned that “unwarranted cynicism” should not overshadow climate action and that there will be “a lot of trial and error” in the developmental stage of Malaysia’s carbon market.

“There is (a need) on both parts – the regulators and the regulated — for sincerity, integrity and indeed, doing what we say we will do,” said Nik Nazmi. “Concepts like BCX are exciting and possibly necessary for climate action, but they need public support.”

Carbon policy by this year

It will take four to five years for Southeast Asia’s carbon markets to develop sufficient liquidity to support active markets, said James Larmouth, head of carbon trading at energy and commodities trader Vitol Asia. Vitol was the largest buyer of carbon credits on BCX during its first two days of open market trading.

“Many more national frameworks are appearing, which is great. And with that, (demand) will come. It’s not going to come overnight,” Larmouth said.

Fellow speaker Dr Riza Suarga, chairman of the Indonesia Carbon Trade Association (IDCTA) , acknowledged that among the challenges squeezing carbon market participants is a current mismatch in international standards and national regulations.

To address this, IDCTA is working with the world’s largest carbon credit certifier, Verra to harmonise national and international carbon credit standards and the registration of carbon projects. Indonesia launched its carbon exchange on 26 September, which is voluntary for now but could be used by the government as part of long-term plans to implement a cap-and-trade system.

“I already have 12 projects within my pipeline,” Suarga said, saying that he does not plan to wait for investor demand to pick up before these projects are developed. “I keep on going because I trust (carbon credits) will be sold.”

In Malaysia, where land laws are governed by individual states, alignment of carbon policies for forest carbon projects is being sought by state governments, said Nik Nazmi. “I can and have assured them (the state governments) that my ministry is doing our best to ensure that these discussions take place” he said, adding that it is the ministry’s wish for the talks to be fruitful.

The natural resources, environment and climate change ministry is preparing to implement the country’s national carbon policy this year, which will provide guidance on carbon trading at the state level.

Bursa Malaysia is also making it a priority to grow the local pipeline of carbon projects in Malaysia, which is expected to create a flow of credits to be traded on BCX, said its CEO Umar. He added that the exchange has yet to feature a Malaysian carbon credit for trading but is preparing for the first issuance of credits from a forest-based carbon project in Kuamut, Sabah.

The project involves the conservation of more than 80,000 hectares of rainforest in Sabah that were previously earmarked as a timber logging concession. It has been registered by Verra as a Verifed Carbon Standard project and is currently being verified for a triple gold labelling under Verra’s co-benefit standard of climate, community and biodiversity.

A voluntary carbon market handbook for Malaysia was also launched on Thursday, which provides a reference point for interested market players and defines the roles and functions of key entities in the country’s carbon market operations. It was jointly produced by Bursa Malaysia and the Malaysian Green Technology and Climate Change Corporation.

Umar said he believes carbon project prospects in Malaysia are strong and the creating valuable carbon credits is possible. However, there needs to be stronger participation from state governments and Corporate Malaysia from today for this to happen and for BCX to truly move the needle,” he said.