Fewer Singapore-listed companies are linking sustainability metrics to their top executive pay, overall business strategy and financial performance, despite improvements in sustainability reporting, according to a new study by the Singapore Exchange Regulation (SGX RegCo) and National University of Singapore (NUS) Business School.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

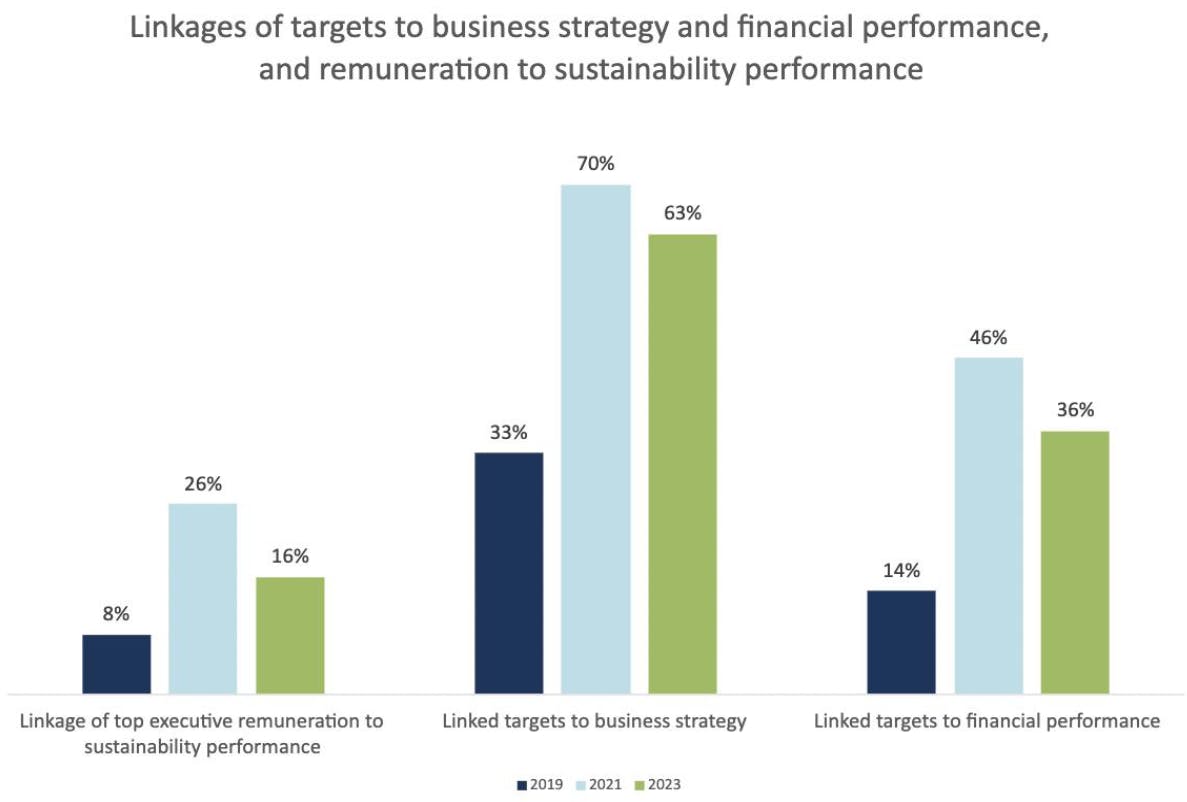

The SGX’s biennal sustainability reporting review, which was first conducted in 2019, found that the number of listed companies with ESG-linked executive remuneration declined from 26 per cent in 2021 to 16 per cent this year. This constitutes roughly 60 companies that have backtracked from linking executive pay to sustainability goals.

This backsliding could be due to the macroeconomic headwinds that have hit the bottom lines of issuers in the past two years, said Professor Lawrence Loh, director of the Centre for Governance and Sustainability at NUS Business School at the media briefing.

As a result, instead of sustainability, they may have linked executive remuneration to “more fundamental factors that directly hit their business performance,” said Loh. The report did not specify which companies made a u-turn on this.

A similar trend was observed for the proportion of issuers that linked sustainability targets to overall corporate strategy and financial performance, which fell by 7 and 10 percentage points respectively after a substantial improvement in 2021.

While there was an uptick in issuers that linked the remuneration of top executives to sustainability performance in 2021, this number declined in 2023. A similar trend was observed for issuers that linked sustainability targets to overall corporate strategy and financial performance over the same time period. Image: SGX Sustainability Reporting Review 2023

The report stated that linking executive compensation to sustainability objectives was still a nascent practice globally, citing that the Financial Stability Board (FSB) – the global financial watchdog behind the Taskforce for Climate-related Financial Disclosures (TCFD) – has also acknowledged that more time is needed for “a consistent practice” to emerge.

Meanwhile, the quality of sustainability reporting among listed issuers of all sizes has improved this year, with small and medium cap entities – which account for nearly 85 per cent of listed issuers – showing the most significant increase in scores.

In this study, medium cap companies refer to stocks with a total market value between S$300 million (US$224 million) and S$1 billion (US$745 million), while small cap companies are those whose total market value is under S$300 million.

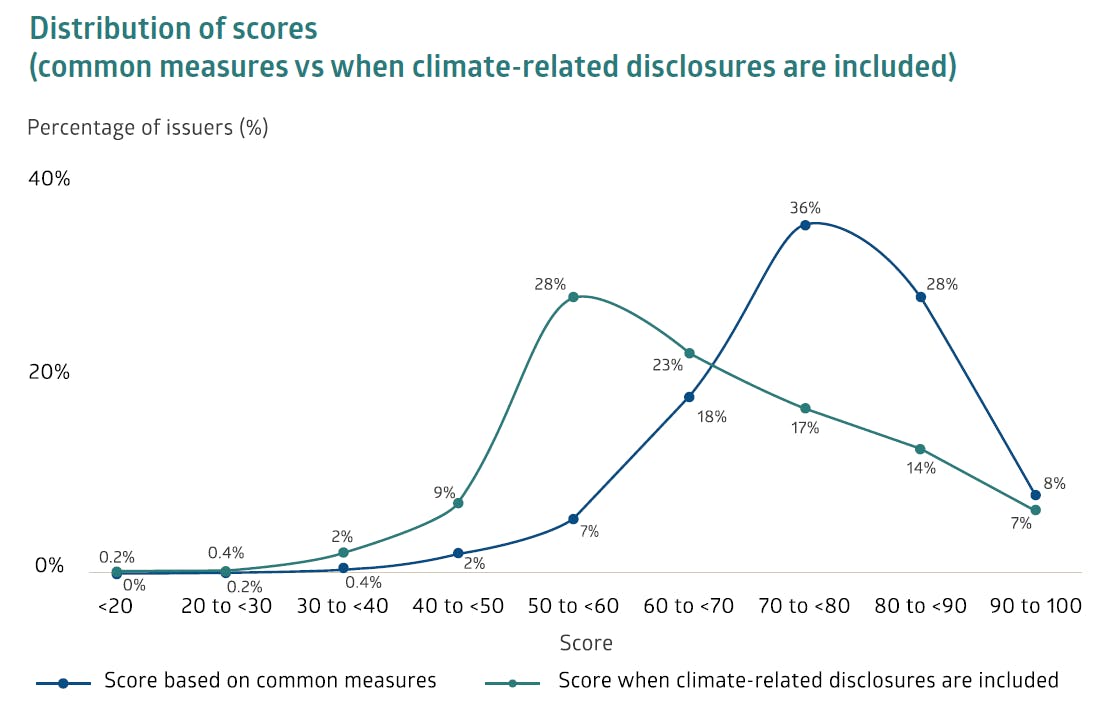

However, just 393 of the 535 listed firms that published their sustainability reports provided climate-related disclosures based on the TCFD framework. Upon incorporating climate-related disclosures, which was assigned the highest weightage in this year’s sustainability reporting scorecard, the average score declined from 75 points to 66 out of the maximum of 100.

After factoring in climate-related disclosures, the average sustainability reporting score fell, with large issuers as well as those from the utilities, consumer non-cyclicals and real estate sectors outperforming their peers. Image: SGX Sustainability Reporting Review 2023

“This report shows that while the people on the ground are already working hard on sustainability reporting, more needs to be done in the climate space. In retrospect, we did the right thing to begin mandating climate reporting, so our companies have an impetus to start reporting early” said Tan Boon Gin, chief executive officer of SGX RegCo.

Grace Fu, Singapore’s minister for sustainability and the environment, similarly emphasised in a statement that “there is room for improvement” in improving the quality of companies’ climate disclosures.

Smaller issuers, in particular, will need to build up their capacity for climate reporting, said Loh.

SGX became the first Asian exchange to propose mandatory climate reporting in with TCFD recommendations in 2021. Since FY 2022, all listed companies have been required to make disclosures on a “comply or explain” basis.

Climate reporting will be made mandatory for issuers in the financial, agriculture, food and forest products and energy industries from FY 2023, before including the transportation as well as materials and buildings sectors from FY 2024.

Among the four pillars of TCFD recommendations, the disclosure rate for climate-related metrics was the highest at 92 per cent. However, progress made in reporting Scope 3 or value chain emissions continues to lag, with just 20 per cent of issuers providing this data.

The disclosure rates for the other three pillars fared less well, where only about 60 per cent of issuers have communicated the board’s oversight of climate-related risks, how climate-related issues have affected their business strategy and the integration of climate risks into overall risk management.

“Across the board, from governance and strategy, to risk management, the three parts need to be looked at, rather than just stipulating targets,” Loh commented.

Hardly any had detailed transition plans

Despite 249, or nearly two thirds, of issuers having climate-related targets, just 65 of them have disclosed some form of a transition plan, such as a net-zero or decarbonisation plan. The bulk of issuers with a transition plan came from the real estate sector, followed by industrials and consumer non-cyclicals.

However, their role of the board and management in driving the transition plan remained vague for many of these issuers.

While 40 issuers said that their boards were involved in drawing up their transition plans, only nine issuers provided detailed terms of reference which establish the specific responsibilties of board members. Fewer than half of issuers with a transition plan provided details about their management’s role in executing the transition plan.

In July, a committee formed by the Accounting and Corporate Regulatory Authority (ACRA) and SGX RegCo launched a public consultation on its proposal to make climate-related disclosures in line with International Sustainability Standards Board (ISSB)’s inaugural standards mandatory for listed and large non-listed companies from FY 2025.

The ISSB standards, meant to provide a global baseline for sustainability-related disclosures, require companies to disclose information about their climate transition plans.

Loh, who is also a member of the committee that sought feedback on this proposal, expects the number of ISSB-aligned disclosures to improve in the lead up to 2025.

“I’m certain that many of the more progressive and active issuers will start their preparations now for the ISSB standards, because many of the elements have been laid out in very definite terms in the consultation paper. That in itself is a roadmap,” he said.

In the report, SGX RegCo identified three key elements a transition plan should contain, including the material climate risks that issuers have identified, a clear governance structure to drive the implementation of the transition plan and actionable near- and long-term science-based targets to achieve net-zero emissions by 2050.

The study showed that majority of climate targets being set by issuers are short-term in nature. Only about a third of third of them are long-term or medium-term climate targets.

“A statement such as ‘our perpetual target is to reduce our environmental impact’ says little. There should be specific short-term, medium-term and long-term targets to allow stakeholders to track progress and align targets with strategic planning,” stated the report.

Omitting negative developments risks greenwash

The study also highlighted potential red flags for investors to spot potential greenwash in sustainability reports.

One red flag was the omission of negative developments in sustainability reports. Only 54 per cent of issuers disclosed unfavourable outcomes in their FY 2022 reports, which could indicate attempts to convey “an overly positive corporate image or that the targets that were met were too ‘soft’ to begin with,” the report wrote.

In light of greenwash concerns, some issuers – mostly large cap issuers, or those with a total market value exceeding S$1 billion (US$745 million) – have sought external assurance for their sustainability reports, though only an internal review is required. This could provide an additional layer of checks against greenwashing, the study stated.

When asked about the digital disclosure portal ESGenome, which was launched in partnership with the Monetary Authority of Singapore (MAS) last year to allow for the automated mapping of ESG metrics to selected reporting standards and frameworks, SGX RegCo’s Tan told Eco-Business that over 30 per cent of issuers have been onboarded to the platform.

MAS’ manager director Ravi Menon previously said there were plans to scale ESGenome into “a national-level disclosure utility that meets the reporting needs of all companies.”

Just last week, the central bank unveiled a revamped utility called “Gprnt” (pronounced “Greenprint”) at the Singapore FinTech Festival, which aims to simplify sustainability reporting for small- and medium-sized enterprises.

Michael Tang, head of Listing Policy and Product Admission at SGX RegCo, who noted this development, told Eco-Business, “We welcome this move because it extends data collection and we’re looking at how ESGenome can be interoperable with Greenprint.”